How Does Marine Cargo Insurance Work?

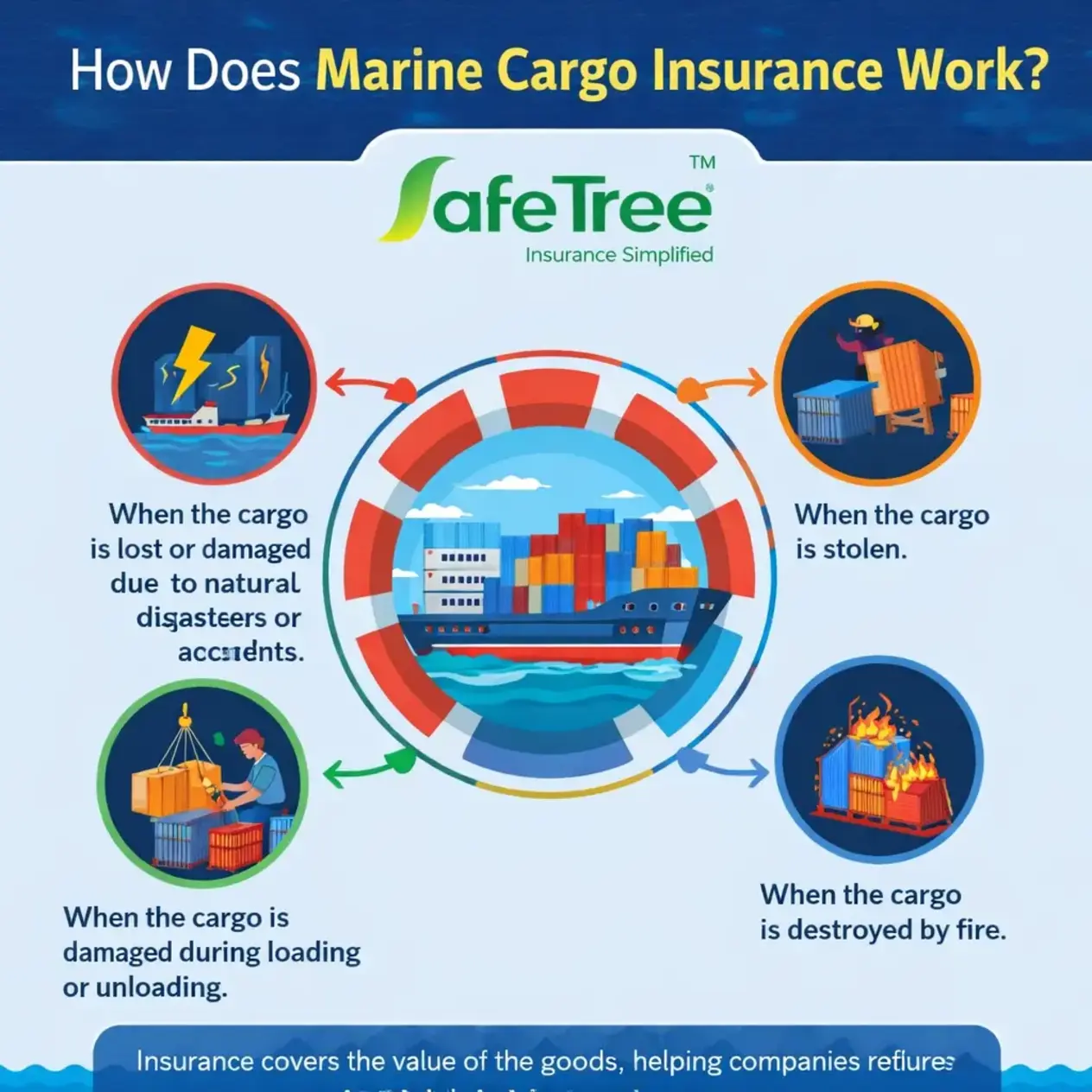

Whenever goods get transported from one city or country to another by any mode of transportation, which includes sea, air, road, or rail. There are so many risks involved, like ships may encounter storms, containers can be mishandled at ports, and theft or accidents can happen during transit. In that case, marine cargo insurance works as a financial protection that helps businesses manage these risks and avoid any major losses if anything goes wrong.

What is marine cargo insurance?

Marine cargo insurance provides compensation to the cargo owner if cargo gets lost, damaged, or stolen while in transit. This policy helps in protecting shipments from the moment they leave the warehouse until they reach the destination, including the loading and unloading of cargo.

Marine cargo insurance applies to goods transported by sea, road, air and rail. This helps you to protect the full invoice value of the goods in case of any loss.

How Does Marine Cargo Insurance Work?

Here is a step-by-step guide to check how marine cargo insurance works:

1. Assess Your Shipment

Before purchasing a policy, you must know:

- What type of goods you are shipping

- The value of your cargo

- Transportation mode (sea, air, road)

- Origin and destination points

These details help in determining the type of policy and the premium you’ll pay.

2. Choosing the Right Policy

There are different marine cargo insurance policy options based on your needs:

- Single transit policy – This policy covers one shipment only.

- Open policy – This policy covers multiple shipments over a period

- Annual or sales turnover policy – This is ideal for businesses that ships goods regularly

Each policy type offers different levels of flexibility and convenience.

3. Paying the Premium

Once you choose the type of coverage, you will pay a premium, typically a small percentage of your cargo’s value, which depends on:

- Shipment value

- Transport mode

- Risks involved

- Packaging and handling quality

4. Coverage During Transit

Once you buy the policy, the insurance kicks in while your goods are:

- Being loaded and unloaded

- In transit between locations

- Stored temporarily at terminals or warehouses

If anything goes wrong with your cargo, this policy can help you cover the financial losses.

5. Filing a Claim

If any mishappening occurs, inform the insurer immediately and submit the required documents, which generally include the invoice, bill of lading and survey report. Once you submit the required documents, the insurer will review and settle the claim. The compensation paid is based on the insured value of the goods.

What is covered under marine cargo insurance?

Marine cargo insurance generally covers:

- Loss or damage occured due to accidents

- Damage from natural causes like storms

- Theft during transit

- Mishandling of cargo during loading/unloading

- Loss due to collision or overturning of transport vehicles

The exact coverage depends on the type of policy you choose.

What is excluded under marine cargo insurance?

Marine cargo insurance policies generally excludes the following: –

- Damages caused by poor packaging.

- Losses caused intentionally by the shipper or their employees.

- Wear and tear of goods.

- Losses occur due to war or terrorism.

- Damages occur because of delays in delivery.

- Risks related to unfit containers or temperature-sensitive goods unless specifically covered.

Always check your policy document carefully to understand exclusions under your plan.

Types of marine cargo insurance policies

Here are the marine cargo insurance policies available:

1. Single Transit Policy

This policy covers only one shipment from origin to destination.

2. Open Policy

This policy covers multiple shipments during a policy period without issuing a fresh contract every time.

3. Annual or Turnover Policy

This policy is designed for businesses which regularly ship goods, and it covers all shipments.

Who should buy marine cargo insurance?

Marine cargo insurance is ideal for:

- Exporters and importers

- Manufacturers

- Wholesalers and distributors

- E-commerce businesses

- Freight forwarders and logistics companies

If your business totally relies on transporting goods, especially internationally, then having cargo insurance is a smart move.

Why is marine cargo insurance important for your businesses?

Marine cargo insurance helps you to –

- Reduces financial risk

- Helps meet contractual requirements

- Protects business reputation

- Ensures continuity even after losses

- Provides peace of mind during transit

Conclusion

When consignments move from one place to another, there is always a risk involved. Marine cargo insurance helps you to reduce these risks by offering financial protection in case the cargo gets damaged, lost, or stolen during transit. For businesses which depend on regular shipments, marine cargo insurance makes it easier to choose the right policy and avoid any unexpected losses.

SafeTree supports businesses by making marine cargo insurance easily accessible. With the right cargo insurance shipments can move easily, which allows businesses to focus on their operations instead of worrying about consignments.

Disclaimer: This blog is intended for general information only. Insurance coverage and benefits may vary, so readers should refer to policy documents or consult our expert before making decisions.