Safetree launches Exclusive Insurance Products for Surrogate Mother

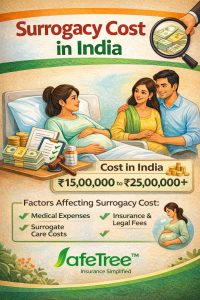

Surrogacy insurance in India has become an essential component of the surrogacy journey, ensuring financial security and compliance with legal requirements under the Surrogacy (Regulations) Act, 2021. This insurance provides comprehensive coverage to address medical and other risks associated with the surrogacy process, safeguarding the interests of both the surrogate mother and the intended parents.

These tailored surrogacy insurance plans are offered by Safetree Insurance, a leading insurance provider for oocyte donors and surrogate mothers, and are underwritten by leading health and life insurance companies.

Safetree has insured over 50,000 oocyte donors and 650 surrogate mothers.

These insurance products are included in the list approved for surrogate mothers as per IRDAI and the National ART & Surrogacy Board.

Key Features of Surrogacy Insurance

-

Mandatory Coverage:

As per the Surrogacy (Regulation) Act, it is mandatory for intended parents to secure insurance coverage for the surrogate mother for the period of 36 months (3 years). This ensures her well-being throughout the surrogacy process and provides financial protection against medical complications.

-

Insurance Products:

a) Surrogate Mother Health Insurance for Medical Expenses:

Covers hospitalisation for complications to the surrogate mother for 36 months. Further this product covers

- Emergency Situations: Addresses unforeseen medical emergencies or hospitalisations.

- Postpartum Delivery Complications: Ensures the surrogate mother receives adequate support even after childbirth.

- Optional Maternity Cover: Covers the cost of delivery (both normal & C-section).

b)

Surrogate Mother Life Insurance

- Coverage Period: The insurance is required to cover a minimum of 36 months, starting from the date the surrogacy agreement is signed.

- Both products are competitively priced. We understand surrogacy can be expensive, and our Health and Life Insurance for surrogate mothers are competitively priced.

- Protection for Surrogate Mothers: This insurance acts as a safety net, ensuring that surrogate mothers are not financially burdened in case of medical complications.

- Compliance and Peace of Mind: By adhering to the legal mandate, intended parents can focus on their journey without concerns about regulatory penalties or unforeseen financial liabilities.

How to Avail Surrogacy Insurance?

You can visit our website or call our experts.

Intended parents can contact Mr Shiva Vikas at 9210044039

or vikas.kumar@safetree.in or Mr Gaurav Pandey at 9811699204

or gaurav.pandey@safetree.in

Surrogacy insurance not only fulfils a legal obligation but also demonstrates a commitment to the welfare of surrogate mothers, fostering a positive and secure environment for all stakeholders.