What is IDV and how is it decided?

Whenever you buy or renew your motor insurance, you must hear the term IDV (insured declared value). While it might look like just another piece of insurance jargon, it is actually the most important thing in your policy. Whether you drive a car or ride a bike, knowing IDV is essential to ensure you aren’t overpaying for your premium.

In this blog, we’ll break down everything you need to know about IDV and how to calculate it.

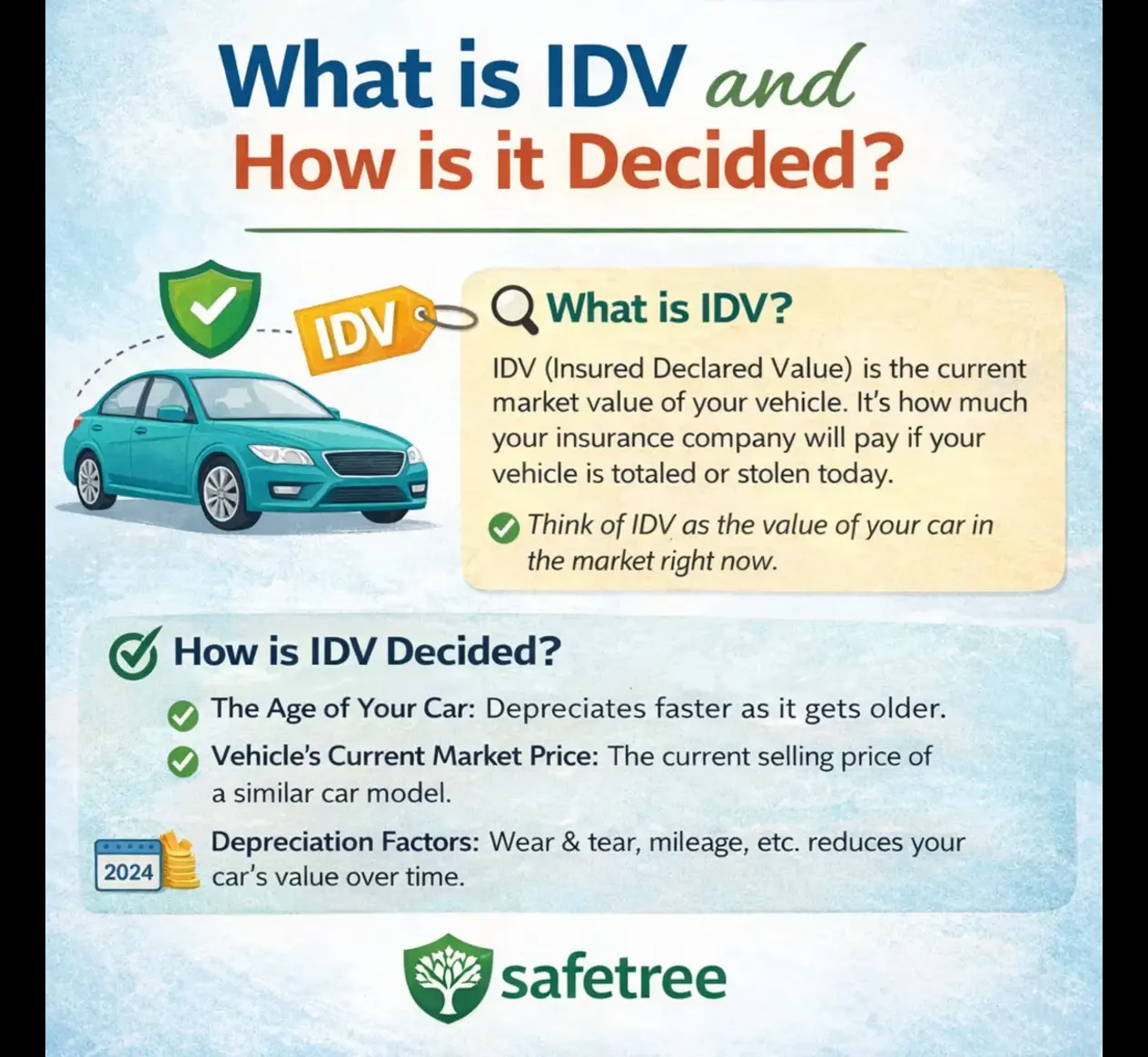

What is IDV in insurance?

IDV stands for Insured Declared Value. In simple terms, it is the maximum sum assured by the insurer which is provided to the policyholder in case of total loss (theft or damage beyond repair).

The main purpose of IDV is to determine the compensation you will receive from the insurer in the event of a covered claim. It also plays a significant role for your insured vehicle, as it directly impacts the cost of insurance premiums.

IDV in Bike Insurance

IDV in bike insurance represents the maximum claim amount you can receive if your bike is stolen or completely damaged. Since two-wheelers depreciate quickly, keeping an eye on your bike’s IDV is important for fair claims.

IDV in Car Insurance

IDV in car insurance is the basis for your own damage premium. A higher IDV means a higher premium but better protection, while a lower IDV reduces your premium but leaves you with a smaller payout during a total loss.

Factors that can affect your insured declared value

Several factors influence the insured declared value of a vehicle:

- Age of the Vehicle: As the vehicle gets older, the IDV decreases due to depreciation.

- Make and Model: Luxury cars or high-end superbikes have different depreciation curves compared to economy models.

- Registration Date: The IDV is calculated from the date the vehicle was first registered.

- Standard Depreciation: The percentage of value lost over time as mandated by the IRDAI.

- City of Registration: Sometimes, the location can slightly influence the market value and subsequent IDV.

How to calculate the IDV for your car & bike?

There is a standard formula for calculating the IDV –

IDV = (Manufacturer’s listed selling price – Depreciation) + (Accessories not included in listed price – Depreciation of those accessories)

Note: The registration cost and insurance premium are excluded from the IDV calculation.

For vehicles older than 5 years, the IDV is generally determined by a mutual agreement between the insurer and the policyholder or through a survey conducted by a professional.

How is the cost of depreciation calculated?

Depreciation is the reduction in the value of your vehicle due to wear and tear over time. For IDV purposes, the depreciation is applied to the manufacturer’s listed selling price.

As the vehicle ages, the percentage of depreciation increases, which in turn reduces the IDV.

Standard Depreciation Rates by IRDAI

The Insurance Regulatory and Development Authority of India (IRDAI) has set a standard schedule for depreciation to ensure uniformity across all insurance companies:

| Age of the Vehicle | Depreciation Percentage for IDV |

| Not exceeding 6 months |

5% |

| Exceeding 6 months but not exceeding 1 year |

15% |

| Exceeding 1 year but not exceeding 2 years |

20% |

| Exceeding 2 years but not exceeding 3 years |

30% |

| Exceeding 3 years but not exceeding 4 years |

40% |

| Exceeding 4 years but not exceeding 5 years |

50% |

For vehicles older than 5 years, the IDV is usually 50% or based on the market condition.

Conclusion

Understanding your IDV ensures that you are neither over-insured (paying too much premium) nor under-insured (receiving too little during a claim). It is the “safety net” for your asset.

At Safetree, we believe in complete transparency and helping you find the perfect balance between a pocket-friendly premium and the right valuation for your vehicle. Whether you are renewing your car insurance or buying a new policy for your bike, our experts will help you to calculate the most accurate IDV so you can drive with peace of mind.

We will contact you as soon as possible, please fill in your details!

Share this post:

Facebook Twitter LinkedIn WhatsApp