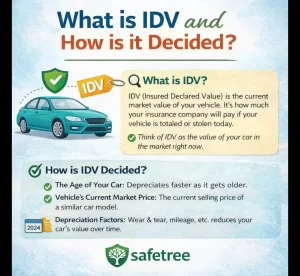

Whenever you buy or renew your motor insurance, you must hear the term IDV (insured declared value). While it might look like just another piece of insurance jargon, it is actually the most important thing in your policy. Whether you drive a car or ride a bike, knowing IDV is essential to ensure you aren’t overpaying for your premium.

- About Us

-

Smart Tools

SME

Health First Health Calculator Risk Janampatri Corporate Risk - Janampatri -

Fettility Tools and Products

Fertility Calculator With Test Fertility Calculator Male Fertility Calculator Fertility Stress Calculator Buy Oocyte Health Insurance Buy Oocyte Life Insurance Buy Surrogate Health Insurance (with Maternity) Buy Surrogate Life Insurance Maternity Insurance for IVF Couples IVF Insurance - Vintage and Classic Cars Insurance Cruise Insurance Tour Operator Liability Insurance Surety Bond Travel Insurance

-

FAQ

Personal Insurance Corporate Insurance POSP -

Legal

Terms of Service Privacy Policy Annual Returns

- About Us

- Smart Tools

- Fettility Tools and Products

- Innovative Products

-

Corporate Insurance

- Our Focus

- Key Sectors

-

Product Offerings

- Contractor All Risk

- Contractor Plant & Machinery

- Commercial General Liability

- Cyber Insurance

- Directors & Officer’s liability insurance

- Distributor’s Lloss of Profit

- Employee Benefits

- Engineering All Risk Insurance Policy

- Errors & Omission

- Fire & Burglary

- Film Production

- Group Medical Coverage

- Marine Insurance

- Machinery Breakdown

- Portable Equipment Policy

- Professional Indemnity Insurance

- Employee Compensation

- Personal Insurance

- POSP Agent

- FAQ

- Contact Us

- Careers

- Blogs & Resources

- Agent Login

- Legal

A2V INSURANCE BROKERS PVT. LTD.

-

Corporate Insurance

Our Focus

Key Sectors

Product Offerings

- Contractor All Risk

- Contractor Plant & Machinery

- Commercial General Liability

- Cyber Insurance

- Directors & Officer’s liability insurance

- Distributor’s Lloss of Profit

- Employee Benefits

- Engineering All Risk Insurance Policy

- Errors & Omission

- Fire & Burglary

- Film Production

- Group Medical Coverage

- Marine Insurance

- Machinery Breakdown

- Portable Equipment Policy

- Professional Indemnity Insurance

- Employee Compensation

-

Personal Insurance

- Oocyte & Surrogate Donors

- IVF Insurance