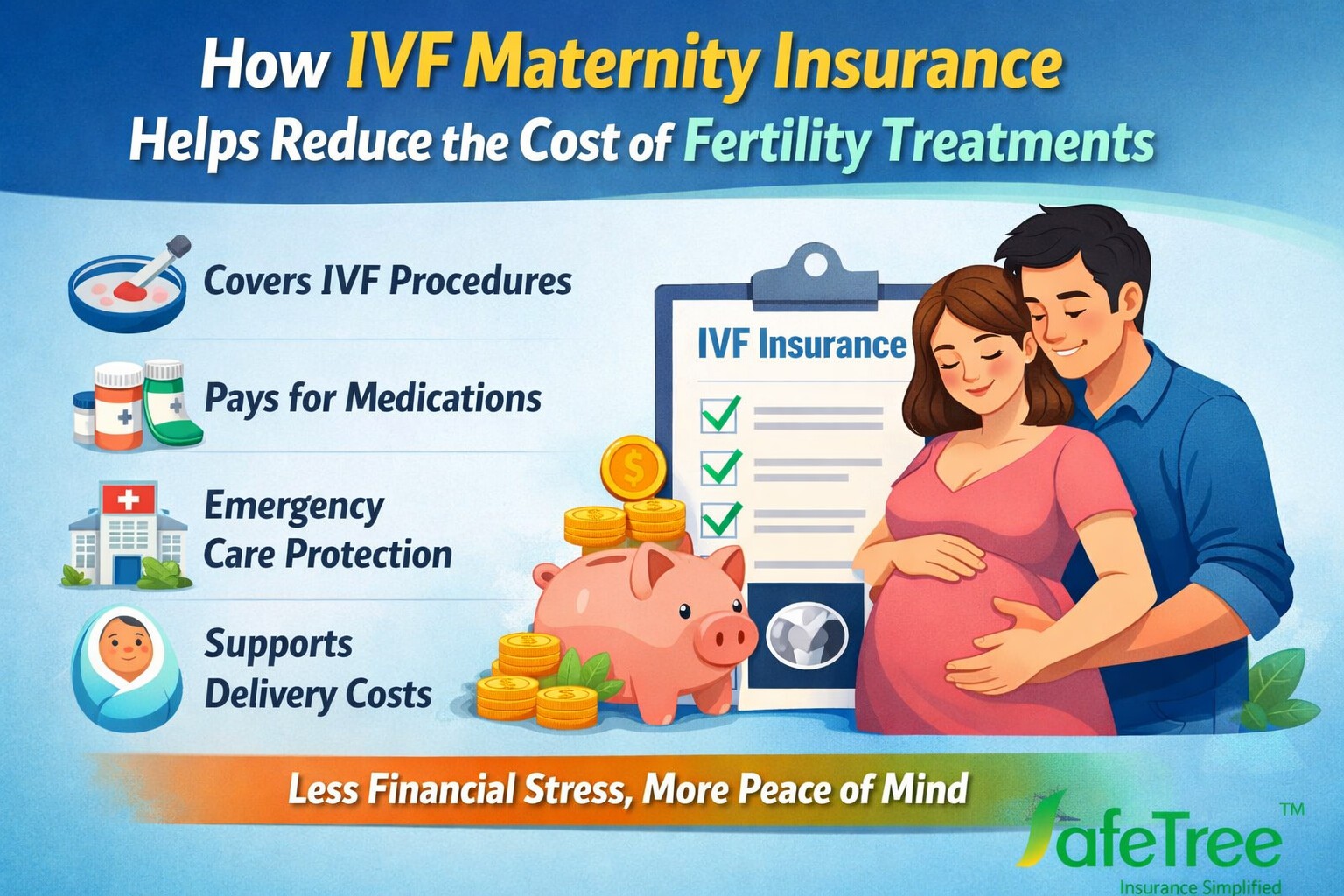

How IVF Maternity Insurance Helps Reduce the Cost of Fertility Treatments?

What is IVF, and why is it so expensive?

IVF (in vitro fertilisation) is a medical process where eggs are retrieved from the ovaries and fertilised by sperm in a specialised laboratory. The resulting embryo is then transferred back into the uterus.

For many couples IVF offers real hope, but it is a high-cost fertility treatment because it requires:

Advanced Lab Facilities: Embryos must be kept in highly controlled cleanrooms with 24/7 monitoring.

Highly Trained Specialists: A team including reproductive endocrinologists, embryologists, and anaesthesiologists is required.

Costly Medicines: Hormonal injections used to stimulate ovaries can cost between ₹40,000 and ₹90,000 per cycle alone.

Sophisticated Equipment: The use of high-end incubators and microscopes (especially for ICSI) drives up the fertility treatment cost.

What is IVF maternity insurance?

IVF maternity insurance is a specially designed policy for women who conceive through assisted reproductive techniques (ART). Unlike standard health insurance plans that usually focus on natural pregnancies, this coverage takes into account the specific challenges of an IVF maternity pregnancy. It recognises the need for closer medical supervision and higher risk management, offering financial support from procedures like egg retrieval right through to childbirth.

Why is IVF Maternity Insurance Important in India?

In India, the cost of IVF treatment is a major hurdle. With medical inflation rising, a single IVF cycle can range from ₹1.5 lakh to ₹4.5 lakh.

Financial Risk: Since the success rate is often 30–50% per cycle, many couples require 2 or 3 attempts. Without insurance, this can lead to a debt of over ₹10 lakhs.

High Demand: With over 2.5 lakh IVF cycles conducted annually in India, insurance has become essential to ensure that couples don’t have to stop treatment due to a lack of funds.

How does IVF maternity insurance help reduce fertility treatment costs in India?

This insurance acts as a financial cushion in three ways:

Cashless Treatment: Many plans allow you to undergo expensive procedures at top fertility chains without paying upfront.

Coverage of Add-ons: It can significantly lower the fertility treatment cost by covering diagnostic tests, blood work, and even lab procedures like embryo transfer.

Complication Management: If a procedure like “ovum pickup” leads to a medical complication, the insurance covers the hospitalisation, which could otherwise cost an extra ₹50,000–₹100,000.

What does IVF maternity insurance coverage typically include?

A comprehensive IVF insurance coverage plan usually includes:

Diagnostic Investigations: Blood tests, USGs, and semen analysis.

Clinical Procedures: Ovarian stimulation, egg retrieval (ovum pick-up), and embryo transfer.

Hospitalisation: Room rent, ICU charges, and nursing care.

Maternity Benefits: Coverage for both normal and C-section deliveries.

Newborn Cover: Immediate medical care for the baby for the first 30–90 days.

What’s the difference between IVF insurance & IVF maternity insurance?

It is vital to distinguish these two:

IVF Insurance: Primarily covers the clinical lab procedures and medications required to achieve a pregnancy. It focuses on the “treatment” phase.

IVF Maternity Insurance: A broader plan that covers the treatment plus the 9 months of pregnancy and the actual delivery. It is a complete “conception-to-cradle” solution.

What is the waiting period for IVF maternity insurance?

Most standard maternity insurance plans in India have a waiting period of 24 to 48 months. However, specialised IVF insurance plans are more flexible:

Safetree Parenthood Plans: Often feature shorter waiting periods, such as 7 months for maternity or 12 months for IVF cycles.

Corporate Plans: In some cases, waiting periods are waived entirely if offered through an employer.

Is IVF maternity insurance worth it?

If you’re planning to conceive through IVF, the short answer is yes. With a premium that’s usually less than 10% of the cost of a single IVF cycle, this insurance helps protect you from unexpected situations such as repeated treatment attempts, pregnancy-related complications, or the need for an emergency C-section. Instead of worrying about sudden medical expenses, you can focus on what truly matters: preparing for your baby and your growing family.

Conclusion

The journey to parenthood through IVF is a deeply personal and emotional one, but it shouldn’t have to be a financial burden that drains your life savings. As we’ve explored, IVF maternity insurance is no longer just a “luxury” add-on; in 2026, it has become a vital financial safety net for couples in India.

By choosing the right plan, you aren’t just buying an insurance policy; you are buying peace of mind. It allows you to focus on what truly matters: your health, your emotional well-being, and the excitement of welcoming a new member into your family, without the constant stress of rising fertility treatment costs.

Frequently Asked Questions

Is IVF covered under maternity insurance?

Typically, standard maternity insurance only covers delivery and newborn care; however, specialised fertility-focused maternity plans now include IVF. These plans bundle the clinical procedure (conception) with the subsequent pregnancy and delivery into a single policy.

Which insurance company covers IVF in India?

Leading providers include Safetree (Parenthood Plans), Care Health (Care Classic), Niva Bupa (Aspire), and Star Health (Women Care). Many of these offer either dedicated fertility policies or optional riders that can be added to a base health plan.

What is the waiting period for IVF maternity insurance?

The waiting period usually ranges from 12 to 24 months for specialised retail plans, though some basic policies may require up to 36 months. In contrast, certain corporate group plans may offer coverage with a much shorter or even zero waiting period.

How to get IVF covered by insurance?

To secure coverage, you must specifically purchase a fertility-focused health plan or add an infertility rider to your existing policy. Since most plans have waiting periods, it is essential to buy the insurance at least 1–2 years before you intend to start your treatment.

Does Insurance Cover IVF in India?

Yes, but it is primarily covered through specialised niche products rather than standard Mediclaim policies. While coverage is increasing in 2026, most plans have “sub-limits” (caps) ranging from ₹50,000 to ₹1.5 lakh per cycle and may limit the number of covered attempts.

We will contact you as soon as possible, please fill in your details!

Share this post:

Facebook Twitter LinkedIn WhatsApp