What is a Performance Bond? How It Works & Why It is Required

Winning a contract is just the beginning of a project. What truly matters for the project owner is the confidence that the contractor will finish the work as promised and within the agreed terms. To reduce this risk, many authorities ask for a performance bond. If you are bidding for government, infrastructure, EPC, or large private sector projects, understanding what a performance bond means and how it works can help you plan better both financially and contractually.

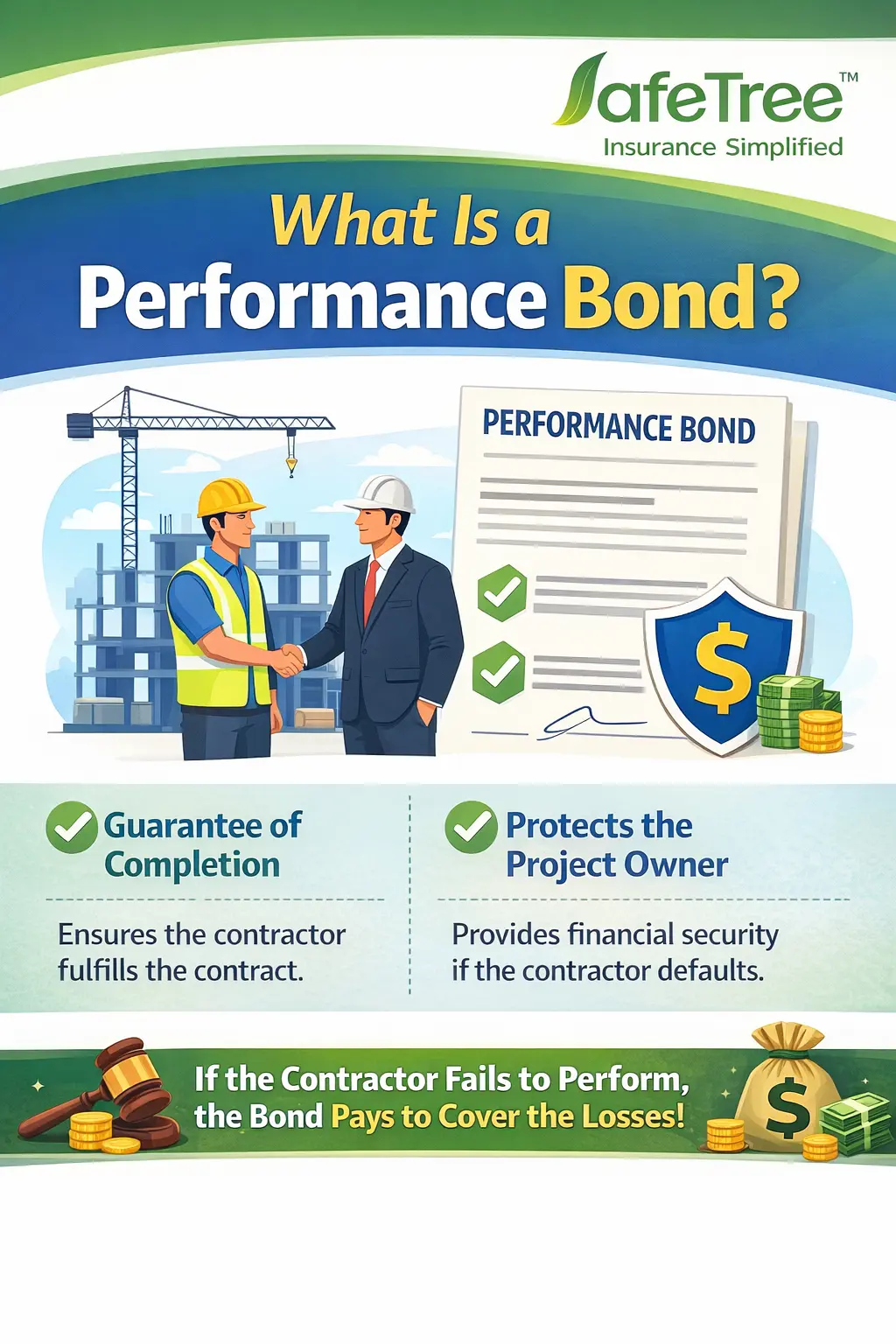

What is a performance bond?

A performance bond is a financial guarantee that gives the project owner confidence that the contractor will complete the job exactly as agreed. In simple terms, it’s a commitment supported by a surety or insurer that the work will be delivered, deadlines will be respected, and the required quality standards will be maintained.

If something goes wrong and the contractor is unable to fulfil the contract, the surety steps in. Depending on the bond terms, they may compensate the project owner for the loss or help arrange completion of the remaining work. Since these guarantees are issued by insurers, they are often informally called performance bond insurance.

How does a performance bond work?

A performance bond kicks in when a contractor lands a project. Once the contract is signed, the project owner typically demands this bond before any actual work starts. Think of it as a financial guarantee, promising the project will be finished as agreed on time, within budget, and to the specified standards. The bond stays in effect while the contractor is on the job, acting as a kind of safety net. If the contractor, for any reason, fails to fulfil their end of the bargain, the project owner can call on the bond. In those instances, the surety steps in, assessing the situation. Depending on the bond’s specifics, they might cover the financial shortfall or assist in getting the remaining work done.

Performance Bond vs Bid Bond

These two are often confused but apply at different stages.

|

Feature |

Performance Bond | |

| When required | After winning the contract | During tender submission |

| Purpose | Ensures project completion | Ensures bidder will accept contract |

| Risk covered | Non-performance during execution | Withdrawal or refusal to proceed |

| Duration | Throughout project period | Till award and agreement |

In short, a bid bond gets you the job, while a performance bond helps you to keep it.

What is the cost of a performance bond?

The price of a performance bond depends on:

- Contract value

- Risk level

- Financial profile

- Project duration

- Underwriting assessment

For many contractors, surety bonds are preferred because they typically avoid large collateral blocks compared to bank guarantees.

Conclusion

A performance bond is essential in today’s world. It offers project owners reassurance and helps contractors establish trust by demonstrating their commitment to fulfilling the contract. When businesses grasp the significance of a performance bond, its mechanics, and the criteria insurers use for approval, they can approach tenders with increased assurance and a more robust competitive position.

As infrastructure and government projects proliferate throughout India, performance bond insurance is often a mandatory requirement. SafeTree assists contractors by streamlining the process, ensuring they obtain the appropriate bond with both clarity and confidence.

We will contact you as soon as possible, please fill in your details!

Share this post:

Facebook Twitter LinkedIn WhatsApp